市值效应与规模因子

薛英杰 / 2022-06-22

读入收益率和Fama-French 五因子数据,分别按照滞后一期的总市值和流通市值分组,统计组合等权收益和对应市值加权收益,并计算市值最小组与市值最大组的收益差。

下面的结果分别为全样本和子样本的累计收益表现和Fama-French因子模型回归,回归方程左手边为小市值组合与大市值组合收益差,右手边为市场(RiskPremiu)、市值(SMB)、价值(HML)、投资(CMA)、盈利(RMW)五个因子。

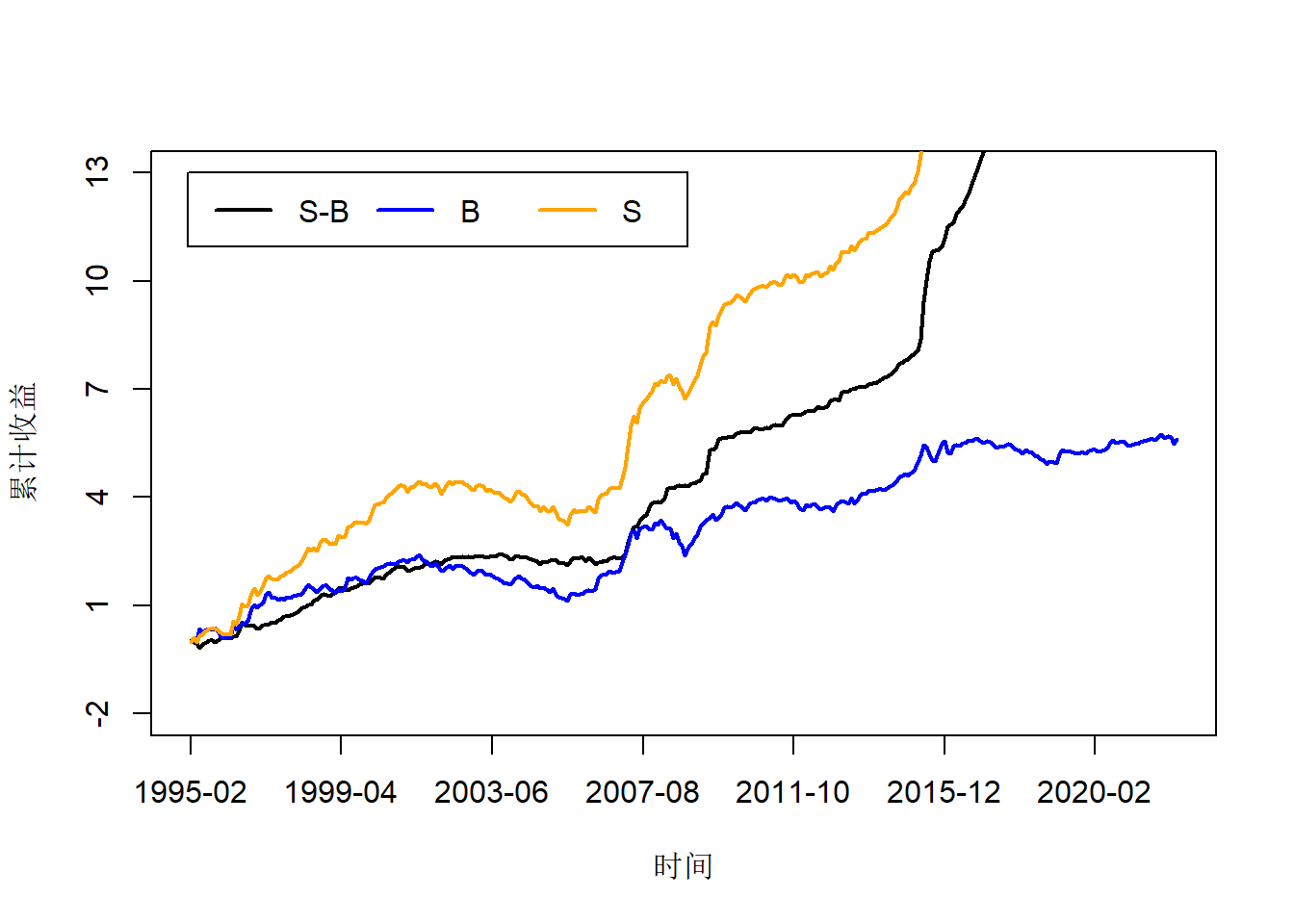

总市值分组(全样本)

pacman::p_load(data.table,stringr,dplyr,foreign,flextable)

options(warn = F)

fivefactort<-read.dbf("E:/科研/五因子模型指标(月)150835535/STK_MKT_FIVEFACMONTH.dbf")%>% ## 读入月度Fama-French五因子

filter(Markettype=="P9714"&Portfolios==2)

## Field name: 'RiskPremiu' changed to: 'RiskPremiu.1'

stockret<-read.dbf("E:/科研/五因子模型指标(月)150835535/TRD_Mnth.dbf") ##股票市值和收益数据

cleandata<-stockret%>%filter(as.character(Trdmnt)>="1995-01"&!str_detect(Stkcd,"^900|^200"))%>%

group_by(Stkcd)%>%

mutate(LMsmvosd=lag(Msmvosd),

LMsmvttl=lag(Msmvttl))%>%ungroup()%>%filter(!is.na(LMsmvosd)&!is.na(LMsmvttl))%>%ungroup()%>%

group_by(Trdmnt)%>%

mutate(Groupsd=cut(LMsmvosd,c(min(LMsmvosd,na.rm=T)-100,quantile(LMsmvosd,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvosd,na.rm=T)+100),labels=1:10),

Groupmvt=cut(LMsmvttl,c(min(LMsmvttl,na.rm=T)-100,quantile(LMsmvttl,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvttl,na.rm=T)+100),labels=1:10))%>%

select(Stkcd,Trdmnt,Groupsd,Groupmvt,Msmvttl,LMsmvttl,Mretnd)%>%

ungroup()%>%

na.omit()

Mvtotal<-cleandata%>%group_by(Trdmnt,Groupmvt)%>%

summarise(Eqret=mean(Mretnd),Wiehtret=weighted.mean(Mretnd,LMsmvttl))%>%

filter(Groupmvt%in%c(1,10))%>%

as.data.frame()%>%

reshape(idvar = "Trdmnt",timevar = "Groupmvt",direction = "wide")%>%

mutate(E10_1=Eqret.1-Eqret.10,

W10_1=Wiehtret.1-Wiehtret.10)

## `summarise()` has grouped output by 'Trdmnt'. You can override using the

## `.groups` argument.

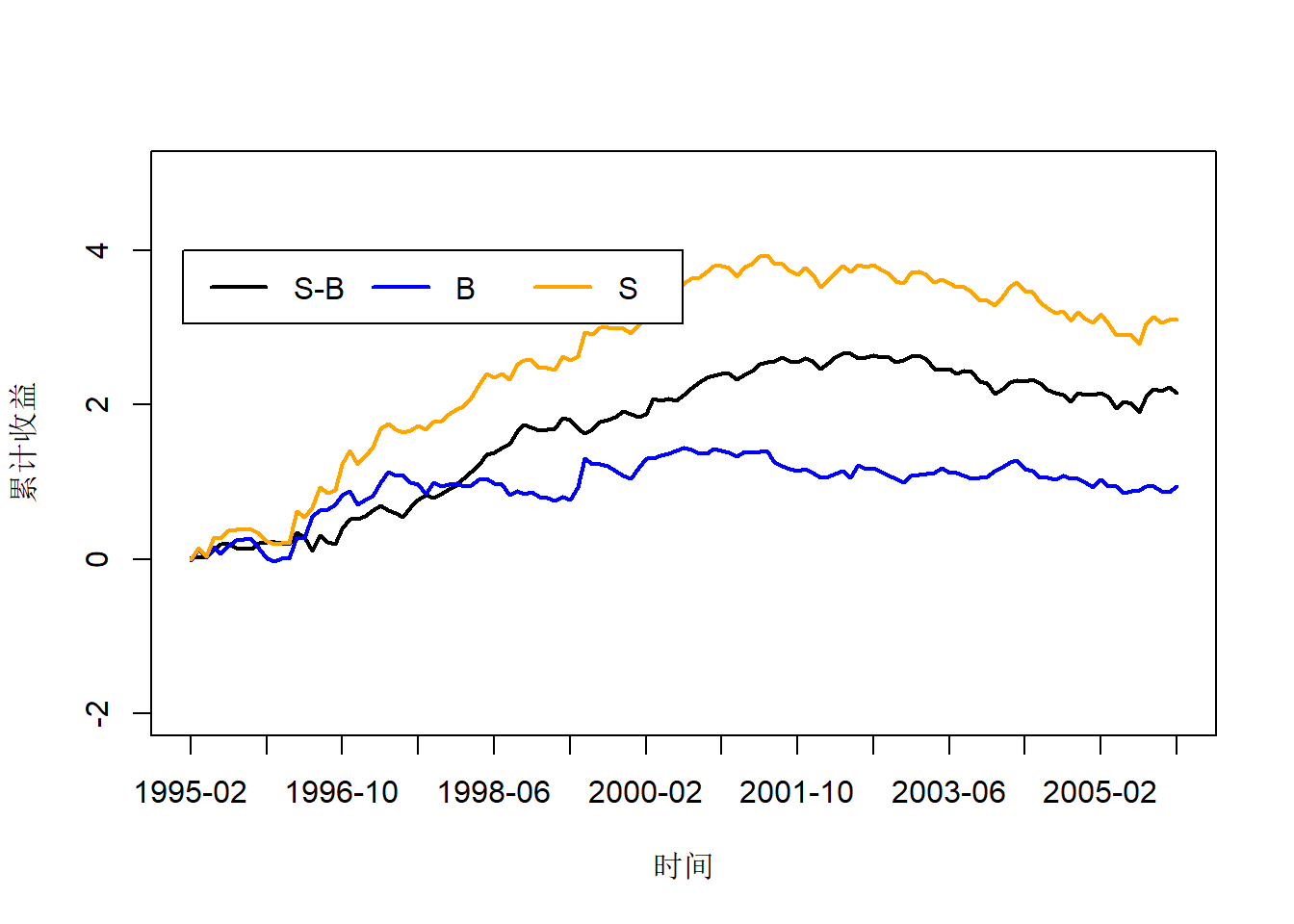

所有时间

factmerg<-Mvtotal%>%

mutate(TradingMon=Trdmnt)%>%

merge(fivefactort,by="TradingMon",all.x = T)%>%

mutate(cumretE10_1=cumsum(E10_1),

cumretE10=cumsum(Eqret.10),

cumretE1=cumsum(Eqret.1),

cumSMB=cumsum(SMB2))

plot(factmerg$cumretE10_1,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2,ylim=c(-2,15))

axis(side =1,at=seq(1,length(factmerg$Trdmnt),50),

as.character(factmerg$Trdmnt[seq(1,length(factmerg$Trdmnt),50)]))

axis(side =2,at=seq(-2,15,3),seq(-2,15,3))

box(lty = "solid")

lines(factmerg$cumretE10,col="blue",lwd=2)

lines(factmerg$cumretE1,col="orange",lwd=2)

legend(0,25,c("S-B","B","S"),lty=c(1,1,1),lwd=c(2,2,2),

horiz = T,col = c("black","blue","orange"),border=F)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.14936 -0.02634 -0.00642 0.01990 0.34556

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.021229 0.002725 7.790 9.3e-14 ***

## RiskPremiu -0.077854 0.034778 -2.239 0.02586 *

## SMB2 1.318360 0.075030 17.571 < 2e-16 ***

## HML2 0.081378 0.116578 0.698 0.48565

## RMW2 -0.412638 0.148000 -2.788 0.00562 **

## CMA2 0.245847 0.156337 1.573 0.11681

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.04796 on 322 degrees of freedom

## Multiple R-squared: 0.6929, Adjusted R-squared: 0.6881

## F-statistic: 145.3 on 5 and 322 DF, p-value: < 2.2e-16

##总市值加权收益回归

分时间段

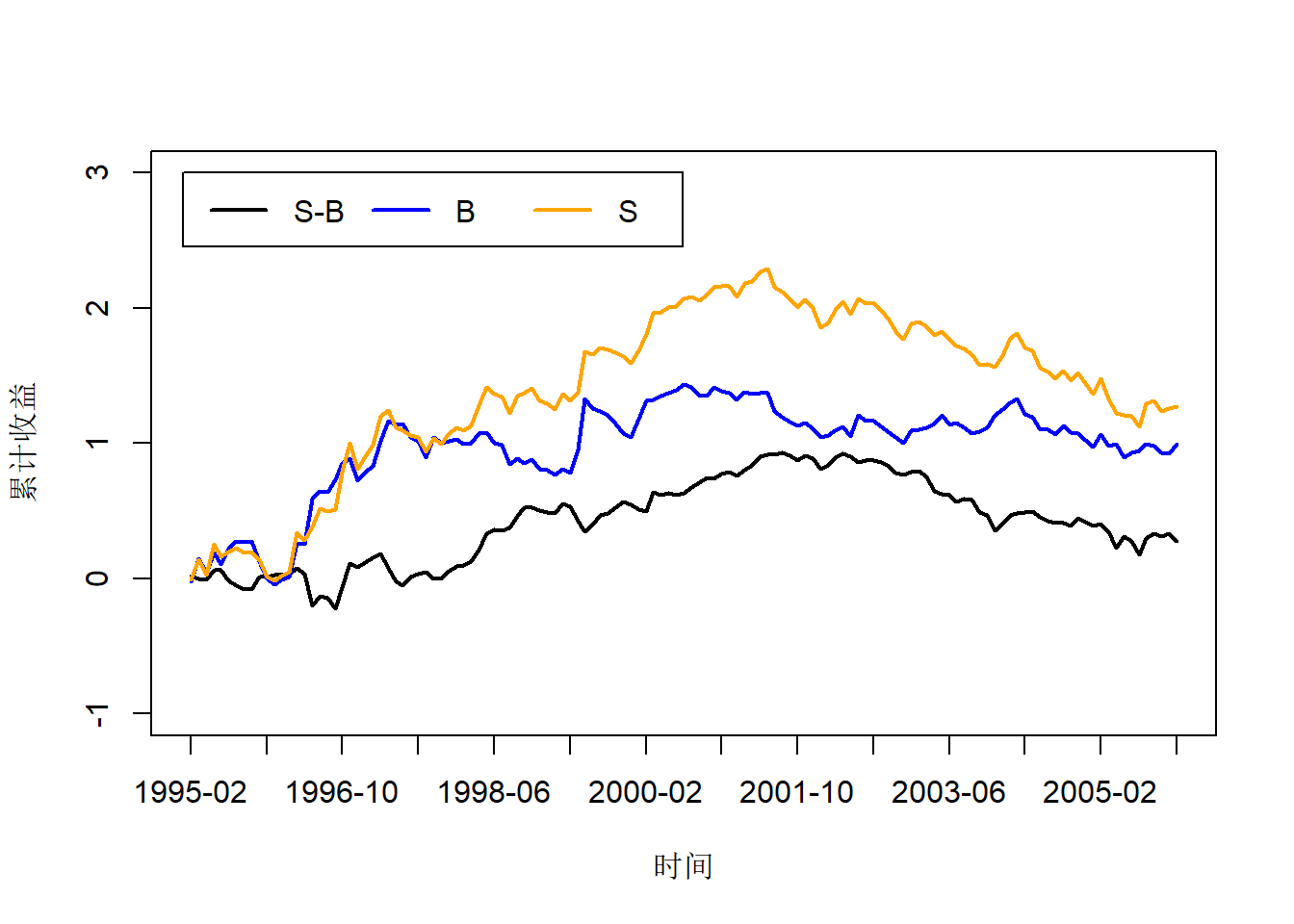

1995年1月至2005年12月

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.046882 -0.014050 -0.004811 0.010895 0.104563

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.01240 0.00231 5.368 3.74e-07 ***

## RiskPremiu -0.03232 0.02831 -1.142 0.255746

## SMB2 1.41462 0.05860 24.138 < 2e-16 ***

## HML2 -0.38593 0.10469 -3.687 0.000337 ***

## RMW2 -0.35391 0.09262 -3.821 0.000208 ***

## CMA2 0.59113 0.11155 5.299 5.08e-07 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.02529 on 125 degrees of freedom

## Multiple R-squared: 0.8833, Adjusted R-squared: 0.8786

## F-statistic: 189.2 on 5 and 125 DF, p-value: < 2.2e-16

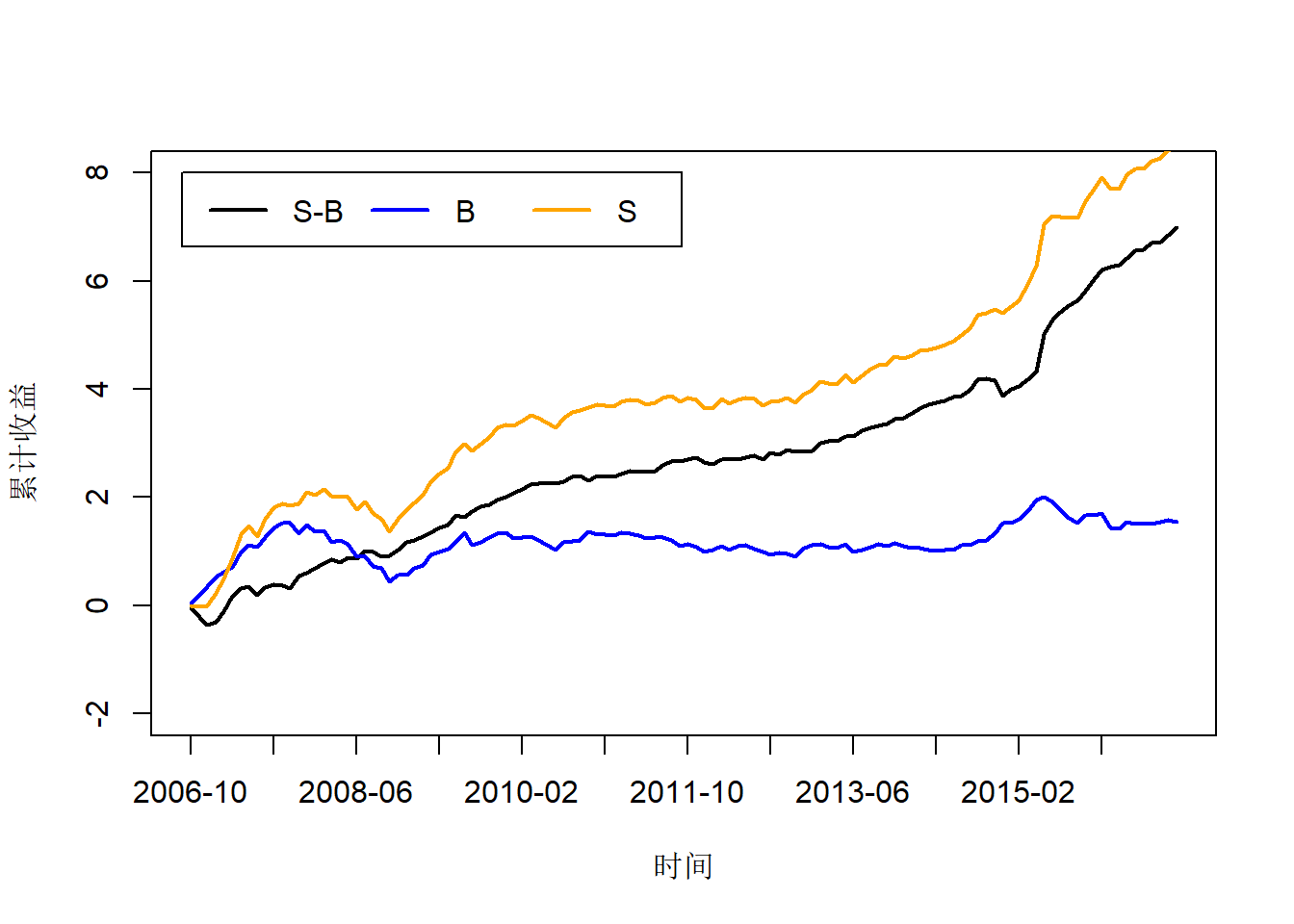

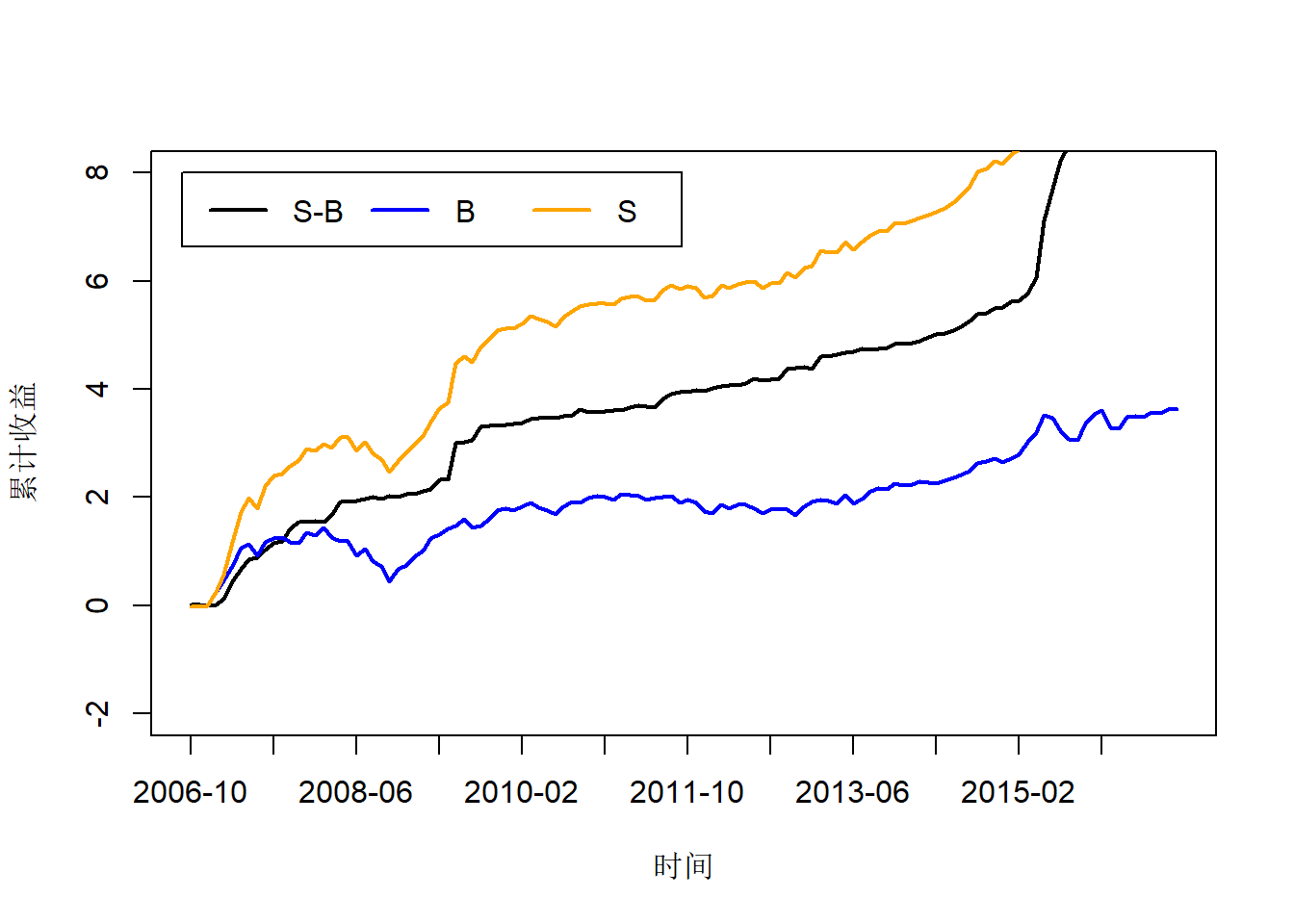

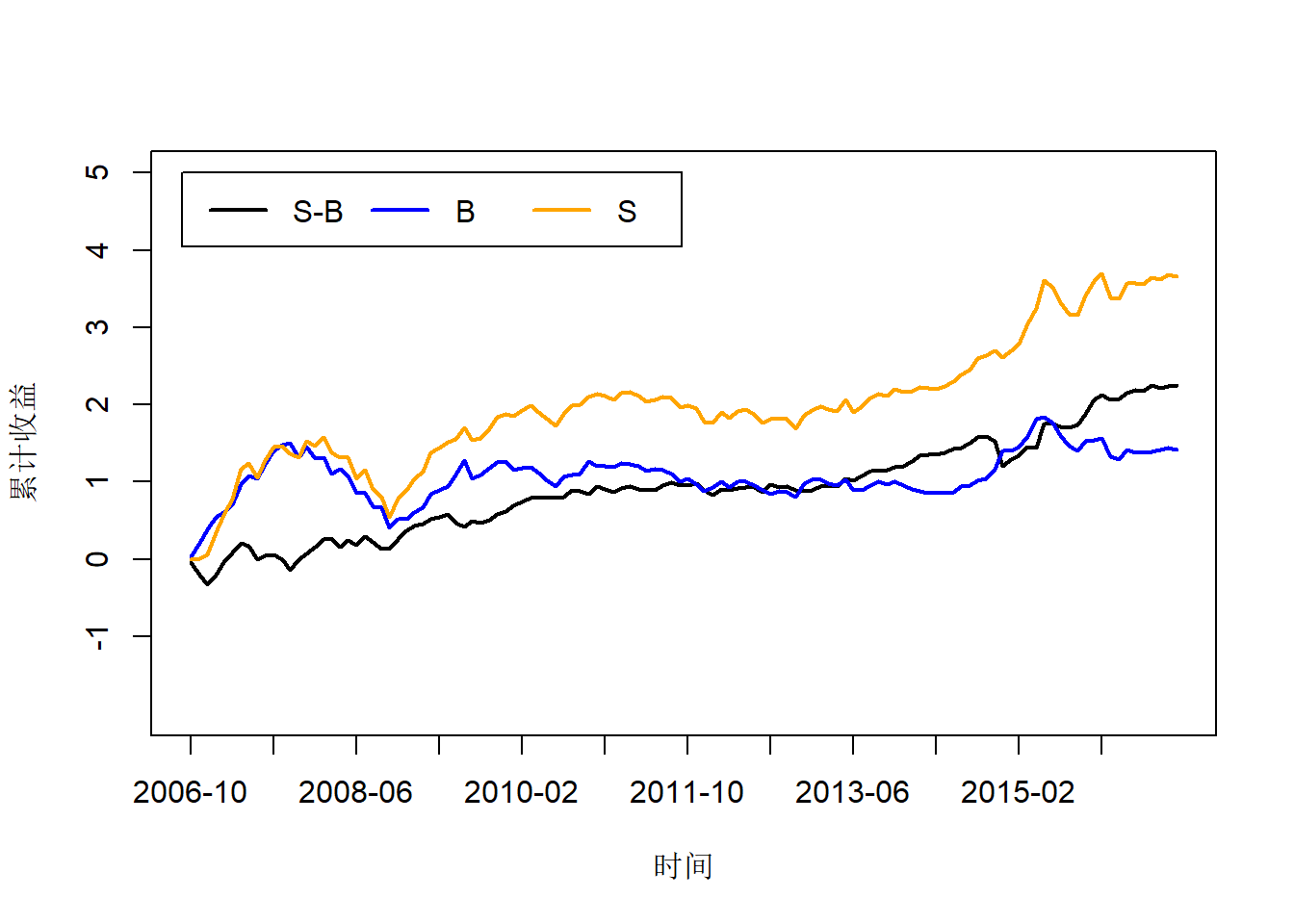

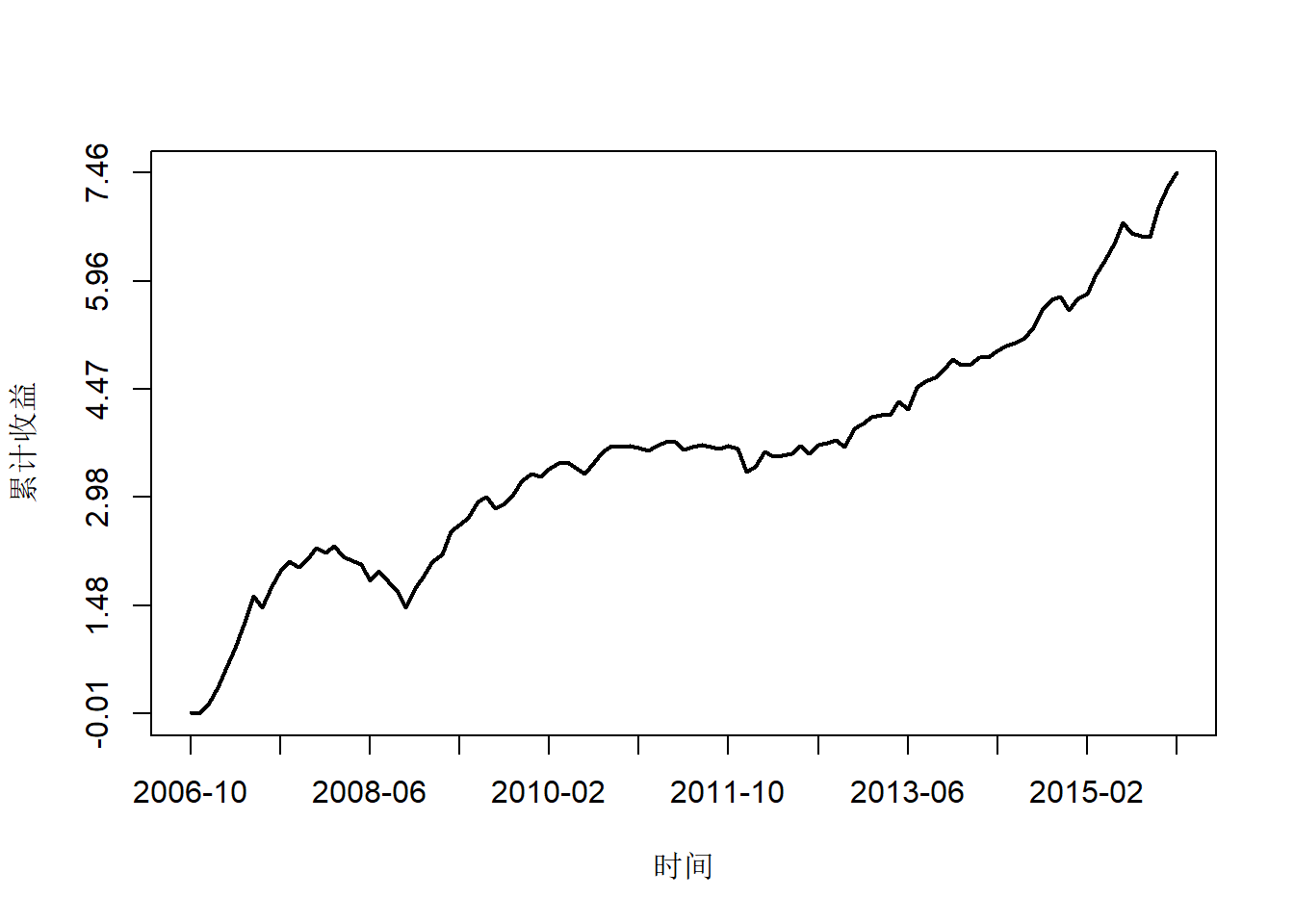

2006年1月至2015年12月

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.08249 -0.03088 -0.01193 0.01709 0.31430

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.036472 0.005923 6.158 1.13e-08 ***

## RiskPremiu -0.071207 0.066440 -1.072 0.286

## SMB2 1.358815 0.193110 7.036 1.57e-10 ***

## HML2 0.233393 0.239012 0.976 0.331

## RMW2 -0.707684 0.471518 -1.501 0.136

## CMA2 -0.665813 0.386884 -1.721 0.088 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.06182 on 114 degrees of freedom

## Multiple R-squared: 0.6568, Adjusted R-squared: 0.6417

## F-statistic: 43.63 on 5 and 114 DF, p-value: < 2.2e-16

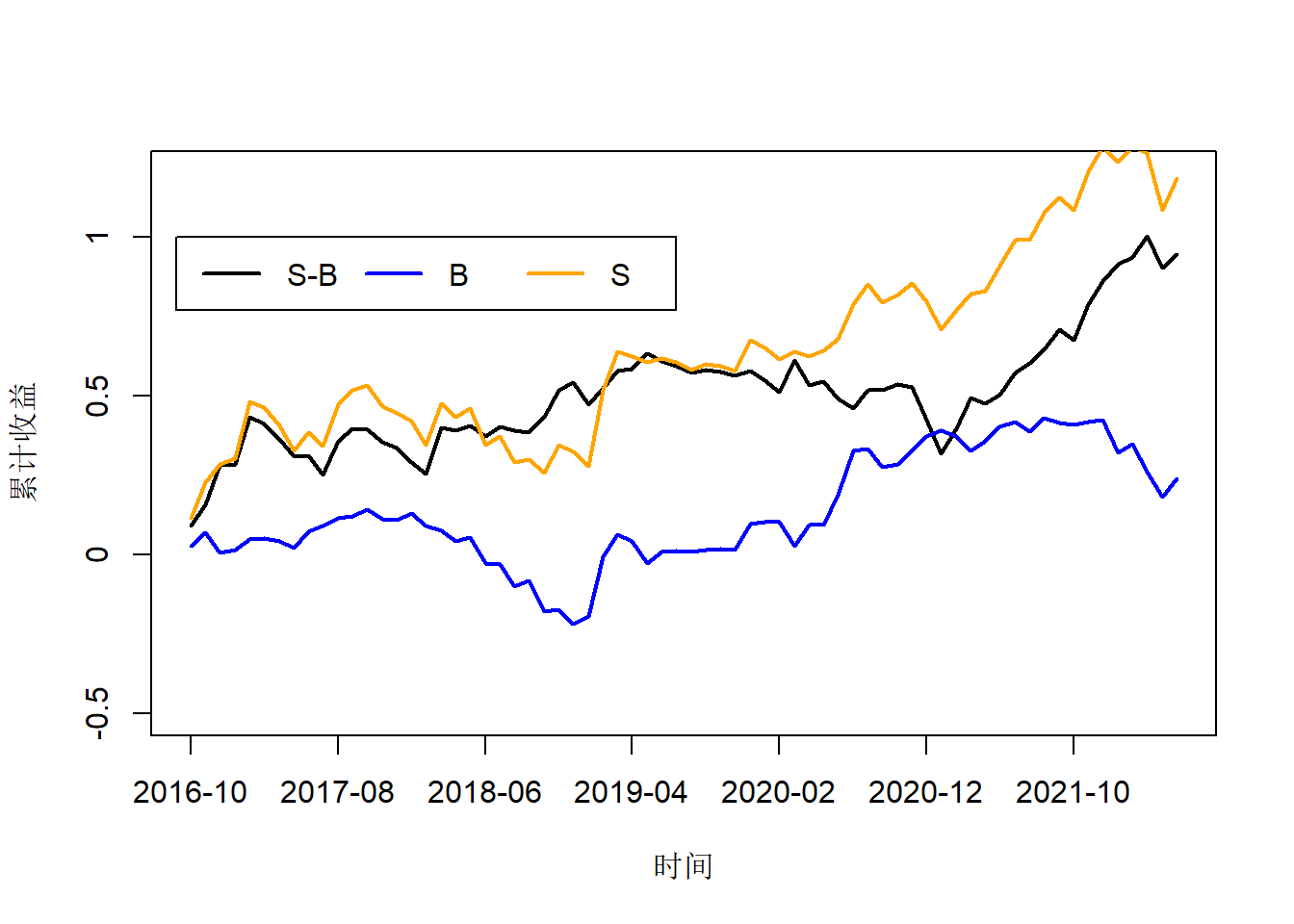

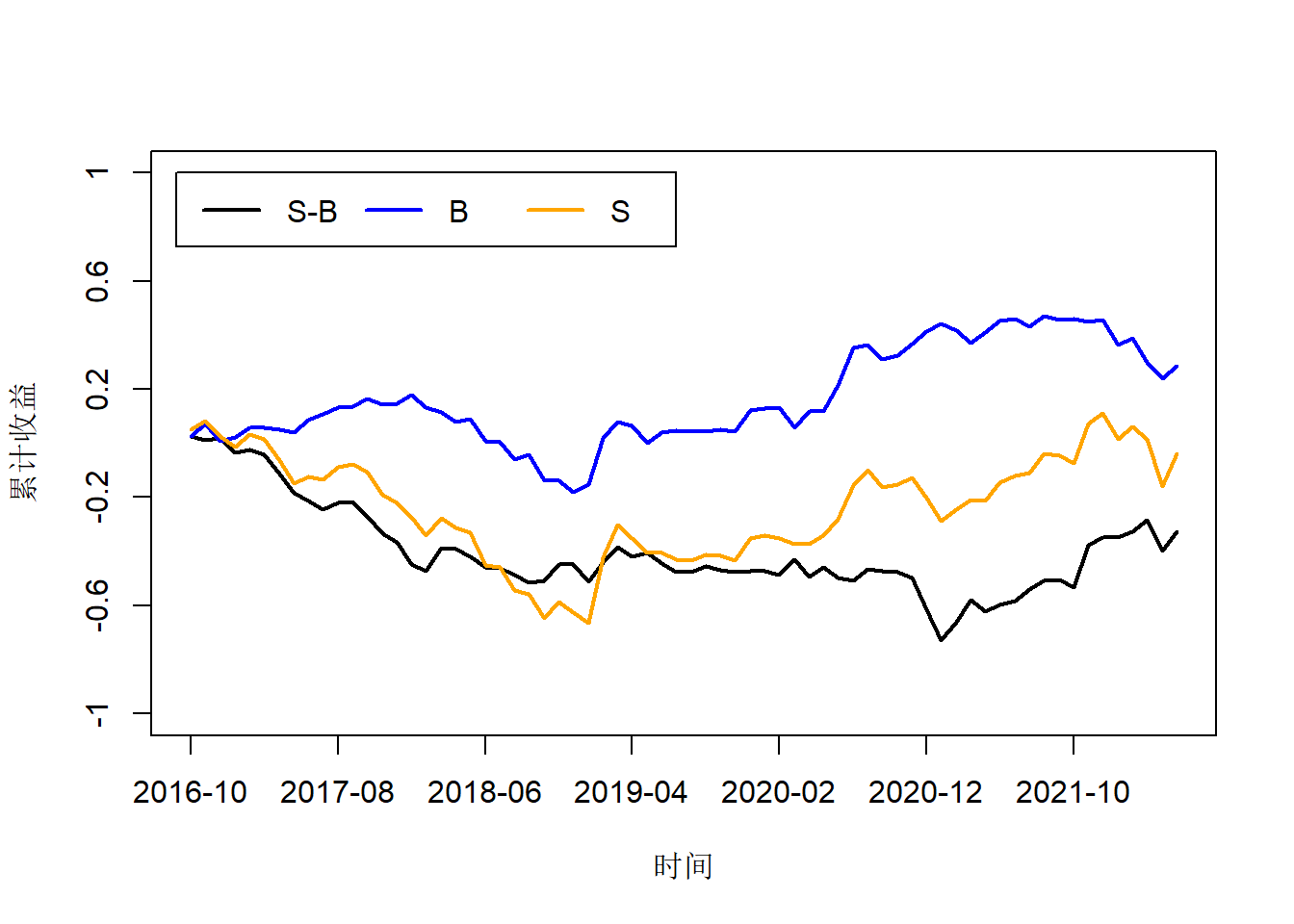

2016年1月至2022年5月

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.056309 -0.018623 -0.007408 0.014514 0.109780

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.019142 0.004448 4.303 6.09e-05 ***

## RiskPremiu -0.073366 0.110836 -0.662 0.5105

## SMB2 1.169670 0.173636 6.736 6.14e-09 ***

## HML2 0.508653 0.273223 1.862 0.0674 .

## RMW2 -0.199665 0.349910 -0.571 0.5703

## CMA2 0.666560 0.394243 1.691 0.0959 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.03536 on 62 degrees of freedom

## Multiple R-squared: 0.6578, Adjusted R-squared: 0.6301

## F-statistic: 23.83 on 5 and 62 DF, p-value: 2.763e-13

总市值分组(市值后30%的股票)

pacman::p_load(data.table,stringr,dplyr,foreign,flextable)

options(warn = F)

fivefactort<-read.dbf("E:/科研/五因子模型指标(月)150835535/STK_MKT_FIVEFACMONTH.dbf")%>% ## 读入月度Fama-French五因子

filter(Markettype=="P9714"&Portfolios==1)

## Field name: 'RiskPremiu' changed to: 'RiskPremiu.1'

stockret<-read.dbf("E:/科研/五因子模型指标(月)150835535/TRD_Mnth.dbf") ##股票市值和收益数据

cleandata<-stockret%>%filter(as.character(Trdmnt)>="1995-01"&!str_detect(Stkcd,"^900|^200"))%>%

group_by(Stkcd)%>%

mutate(LMsmvosd=lag(Msmvosd),

LMsmvttl=lag(Msmvttl))%>%ungroup()%>%

group_by(Trdmnt)%>%

filter(LMsmvttl<=quantile(LMsmvttl,0.3,na.rm=T))%>%

mutate(Groupsd=cut(LMsmvosd,c(min(LMsmvosd)-100,quantile(LMsmvosd,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvosd)+100),labels=1:10),

Groupmvt=cut(LMsmvttl,c(min(LMsmvttl)-100,quantile(LMsmvttl,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvttl)+100),labels=1:10))%>%

select(Stkcd,Trdmnt,Groupsd,Groupmvt,Msmvttl,LMsmvttl,Mretnd)%>%

ungroup()%>%

na.omit()

Mvtotal<-cleandata%>%group_by(Trdmnt,Groupmvt)%>%

summarise(Eqret=mean(Mretnd),Wiehtret=weighted.mean(Mretnd,LMsmvttl))%>%

filter(Groupmvt%in%c(1,10))%>%

as.data.frame()%>%

reshape(idvar = "Trdmnt",timevar = "Groupmvt",direction = "wide")%>%

mutate(E10_1=Eqret.1-Eqret.10,

W10_1=Wiehtret.1-Wiehtret.10)

## `summarise()` has grouped output by 'Trdmnt'. You can override using the

## `.groups` argument.

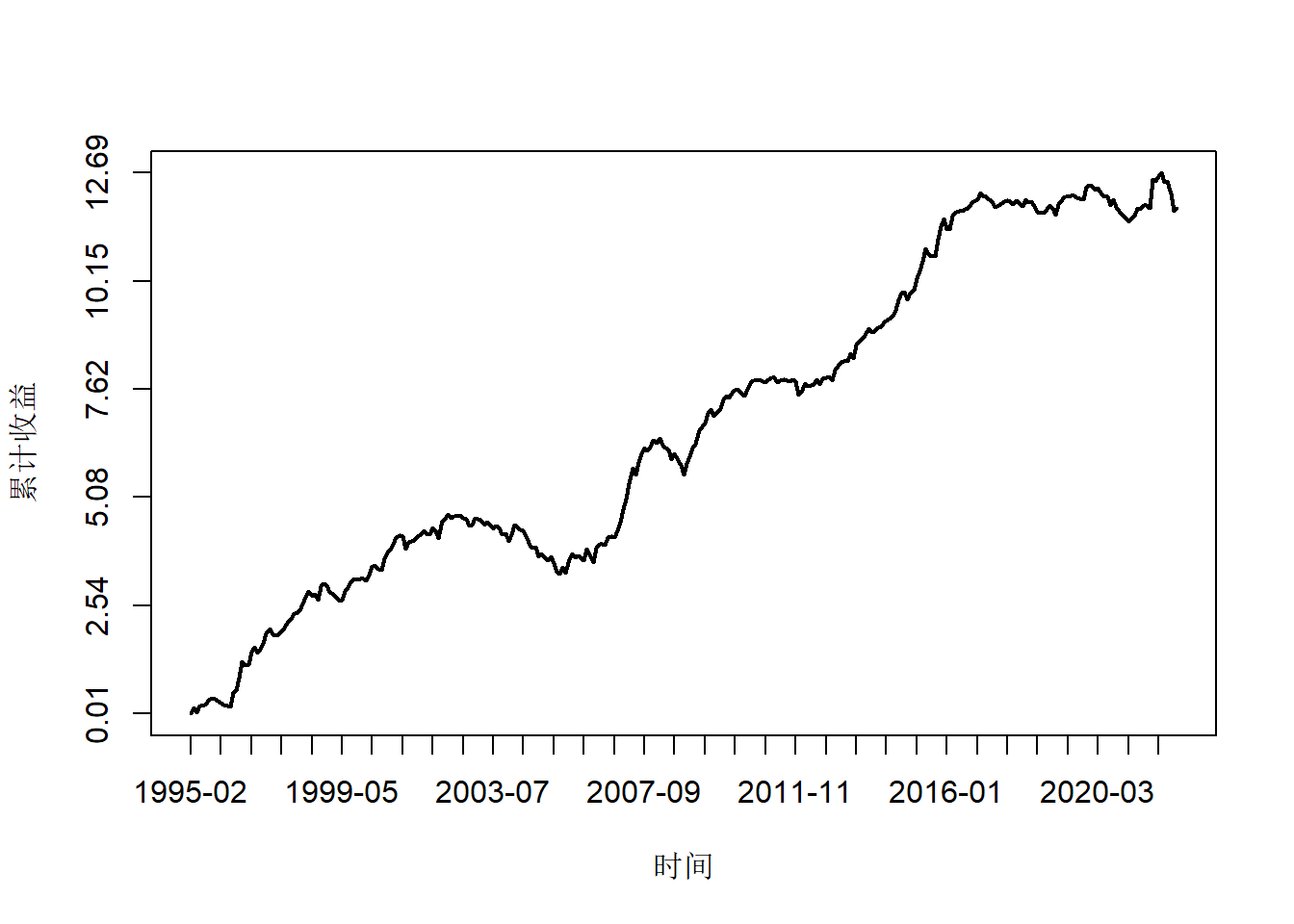

所有时间(市值后30%的股票)

factmerg<-Mvtotal%>%

mutate(TradingMon=Trdmnt)%>%

merge(fivefactort,by="TradingMon",all.x = T)%>%

mutate(cumretE10_1=cumsum(E10_1),

cumretE10=cumsum(Eqret.10),

cumretE1=cumsum(Eqret.1),

cumSMB=cumsum(SMB2))

plot(factmerg$cumretE10_1,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2,ylim=c(-2,13))

axis(side =1,at=seq(1,length(factmerg$Trdmnt),50),

as.character(factmerg$Trdmnt[seq(1,length(factmerg$Trdmnt),50)]))

axis(side =2,at=seq(-2,13,3),seq(-2,13,3))

box(lty = "solid")

lines(factmerg$cumretE10,col="blue",lwd=2)

lines(factmerg$cumretE1,col="orange",lwd=2)

legend(0,13,c("S-B","B","S"),lty=c(1,1,1),lwd=c(2,2,2),

horiz = T,col = c("black","blue","orange"),border=F)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.18014 -0.04931 -0.02324 0.01269 0.90792

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.044557 0.006007 7.417 1.07e-12 ***

## RiskPremiu -0.033898 0.076087 -0.446 0.6562

## SMB2 0.146445 0.175643 0.834 0.4050

## HML2 -0.219871 0.208297 -1.056 0.2920

## RMW2 -0.293276 0.276469 -1.061 0.2896

## CMA2 0.476687 0.264965 1.799 0.0729 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.1052 on 322 degrees of freedom

## Multiple R-squared: 0.06051, Adjusted R-squared: 0.04592

## F-statistic: 4.148 on 5 and 322 DF, p-value: 0.00115

分时间段

1995年1月至2005年12月(市值后30%的股票)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.165240 -0.022961 -0.000835 0.020871 0.189560

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.019299 0.004162 4.637 8.78e-06 ***

## RiskPremiu -0.033037 0.049555 -0.667 0.5062

## SMB2 0.190584 0.105561 1.805 0.0734 .

## HML2 -0.162184 0.141180 -1.149 0.2528

## RMW2 -0.662848 0.153812 -4.309 3.28e-05 ***

## CMA2 0.172836 0.141656 1.220 0.2247

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.0447 on 125 degrees of freedom

## Multiple R-squared: 0.3245, Adjusted R-squared: 0.2975

## F-statistic: 12.01 on 5 and 125 DF, p-value: 1.666e-09

2006年1月至2015年12月(市值后30%的股票)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.13748 -0.07285 -0.04470 0.01622 0.87118

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.07994 0.01440 5.551 1.88e-07 ***

## RiskPremiu 0.03520 0.16172 0.218 0.828

## SMB2 0.38135 0.49640 0.768 0.444

## HML2 -0.19345 0.48678 -0.397 0.692

## RMW2 0.28197 0.84849 0.332 0.740

## CMA2 0.42460 0.76162 0.557 0.578

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.1494 on 114 degrees of freedom

## Multiple R-squared: 0.02651, Adjusted R-squared: -0.01619

## F-statistic: 0.6209 on 5 and 114 DF, p-value: 0.6841

2016年1月至2022年5月(市值后30%的股票)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.13577 -0.04418 -0.01493 0.01893 0.36234

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.032632 0.009773 3.339 0.00143 **

## RiskPremiu 0.050855 0.246372 0.206 0.83714

## SMB2 -0.156735 0.397650 -0.394 0.69482

## HML2 -0.184786 0.571155 -0.324 0.74738

## RMW2 0.560557 0.582259 0.963 0.33942

## CMA2 1.554159 0.793301 1.959 0.05460 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.078 on 62 degrees of freedom

## Multiple R-squared: 0.1148, Adjusted R-squared: 0.04345

## F-statistic: 1.609 on 5 and 62 DF, p-value: 0.171

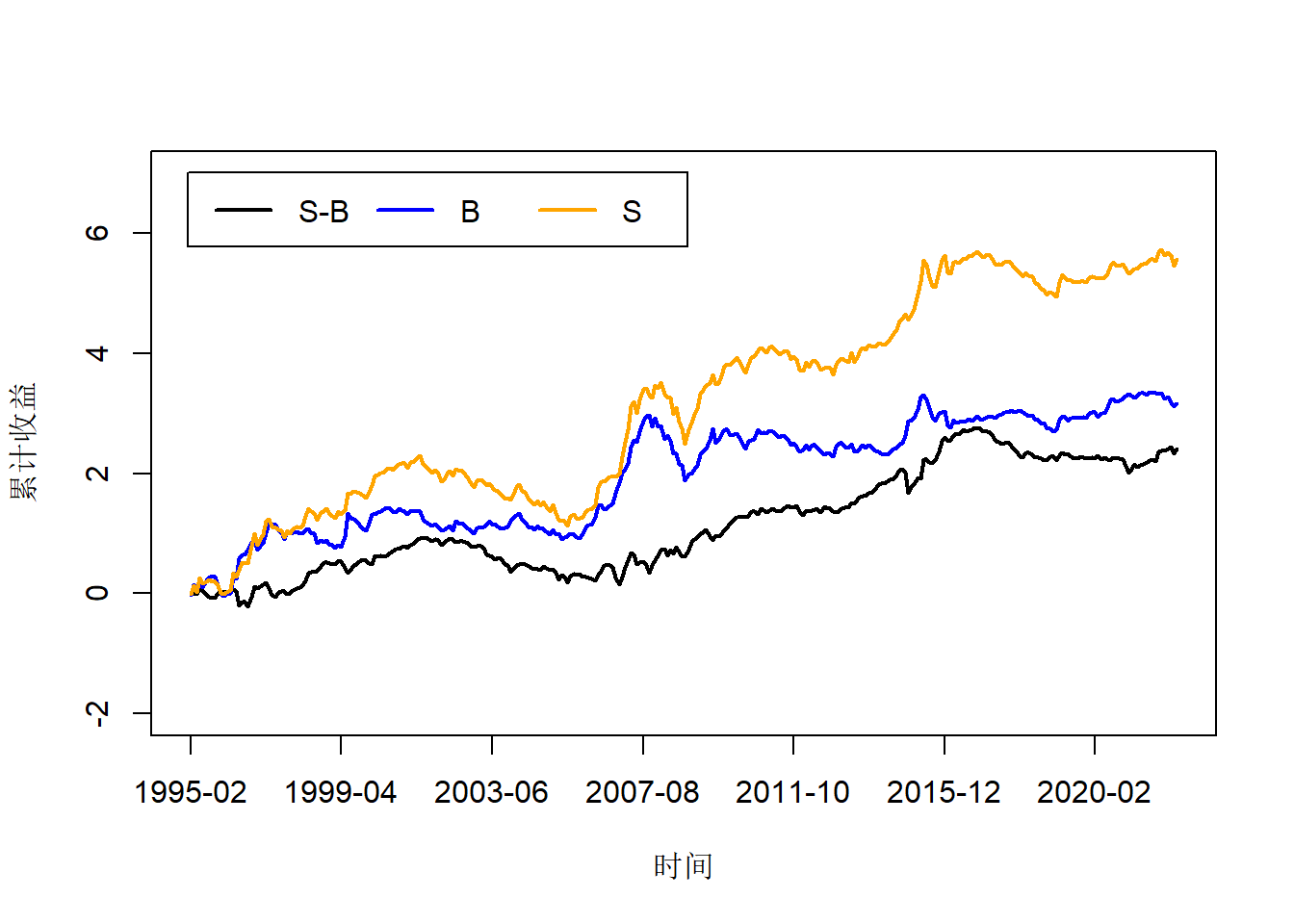

总市值分组(市值前70%的股票)

pacman::p_load(data.table,stringr,dplyr,foreign,flextable)

options(warn = F)

fivefactort<-read.dbf("E:/科研/五因子模型指标(月)150835535/STK_MKT_FIVEFACMONTH.dbf")%>% ## 读入月度Fama-French五因子

filter(Markettype=="P9714"&Portfolios==1)

## Field name: 'RiskPremiu' changed to: 'RiskPremiu.1'

stockret<-read.dbf("E:/科研/五因子模型指标(月)150835535/TRD_Mnth.dbf") ##股票市值和收益数据

cleandata<-stockret%>%filter(as.character(Trdmnt)>="1995-01"&!str_detect(Stkcd,"^900|^200"))%>%

group_by(Stkcd)%>%

mutate(LMsmvosd=lag(Msmvosd),

LMsmvttl=lag(Msmvttl))%>%ungroup()%>%

group_by(Trdmnt)%>%

filter(LMsmvttl>=quantile(LMsmvttl,0.3,na.rm=T))%>%

mutate(Groupsd=cut(LMsmvosd,c(min(LMsmvosd)-100,quantile(LMsmvosd,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvosd)+100),labels=1:10),

Groupmvt=cut(LMsmvttl,c(min(LMsmvttl)-100,quantile(LMsmvttl,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvttl)+100),labels=1:10))%>%

select(Stkcd,Trdmnt,Groupsd,Groupmvt,Msmvttl,LMsmvttl,Mretnd)%>%

ungroup()%>%

na.omit()

Mvtotal<-cleandata%>%group_by(Trdmnt,Groupmvt)%>%

summarise(Eqret=mean(Mretnd),Wiehtret=weighted.mean(Mretnd,LMsmvttl))%>%

filter(Groupmvt%in%c(1,10))%>%

as.data.frame()%>%

reshape(idvar = "Trdmnt",timevar = "Groupmvt",direction = "wide")%>%

mutate(E10_1=Eqret.1-Eqret.10,

W10_1=Wiehtret.1-Wiehtret.10)

## `summarise()` has grouped output by 'Trdmnt'. You can override using the

## `.groups` argument.

全时间段(市值前70%的股票)

factmerg<-Mvtotal%>%

mutate(TradingMon=Trdmnt)%>%

merge(fivefactort,by="TradingMon",all.x = T)%>%

mutate(cumretE10_1=cumsum(E10_1),

cumretE10=cumsum(Eqret.10),

cumretE1=cumsum(Eqret.1),

cumSMB=cumsum(SMB2))

plot(factmerg$cumretE10_1,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2,ylim=c(-2,7))

axis(side =1,at=seq(1,length(factmerg$Trdmnt),50),

as.character(factmerg$Trdmnt[seq(1,length(factmerg$Trdmnt),50)]))

axis(side =2,at=seq(-2,7,2),seq(-2,7,2))

box(lty = "solid")

lines(factmerg$cumretE10,col="blue",lwd=2)

lines(factmerg$cumretE1,col="orange",lwd=2)

legend(0,7,c("S-B","B","S"),lty=c(1,1,1),lwd=c(2,2,2),

horiz = T,col = c("black","blue","orange"),border=F)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.064015 -0.011468 0.000167 0.011395 0.120361

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.000990 0.001225 -0.808 0.419674

## RiskPremiu -0.059711 0.015518 -3.848 0.000144 ***

## SMB2 1.181872 0.035824 32.991 < 2e-16 ***

## HML2 -0.063171 0.042484 -1.487 0.138006

## RMW2 -0.117159 0.056388 -2.078 0.038526 *

## CMA2 0.226446 0.054041 4.190 3.6e-05 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.02146 on 322 degrees of freedom

## Multiple R-squared: 0.8915, Adjusted R-squared: 0.8898

## F-statistic: 529.3 on 5 and 322 DF, p-value: < 2.2e-16

分时间段

1995年1月至2005年12月(市值前70%的股票)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.05833 -0.01488 0.00003 0.01311 0.12699

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.0002171 0.0023075 -0.094 0.92520

## RiskPremiu -0.0782494 0.0274730 -2.848 0.00514 **

## SMB2 1.0940116 0.0585219 18.694 < 2e-16 ***

## HML2 -0.2160831 0.0782691 -2.761 0.00664 **

## RMW2 -0.0862982 0.0852721 -1.012 0.31348

## CMA2 0.3119171 0.0785329 3.972 0.00012 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.02478 on 125 degrees of freedom

## Multiple R-squared: 0.8194, Adjusted R-squared: 0.8122

## F-statistic: 113.5 on 5 and 125 DF, p-value: < 2.2e-16

2006年1月至2015年12月(市值前70%的股票)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.049351 -0.010849 -0.000959 0.011324 0.051726

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.002148 0.001833 -1.172 0.244

## RiskPremiu -0.026381 0.020584 -1.282 0.203

## SMB2 1.364626 0.063187 21.597 <2e-16 ***

## HML2 0.072837 0.061961 1.176 0.242

## RMW2 0.010440 0.108003 0.097 0.923

## CMA2 0.159824 0.096945 1.649 0.102

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.01902 on 114 degrees of freedom

## Multiple R-squared: 0.9431, Adjusted R-squared: 0.9406

## F-statistic: 378.1 on 5 and 114 DF, p-value: < 2.2e-16

2016年1月至2022年5月(市值前70%的股票)

summary(lm(E10_1~RiskPremiu+SMB2+HML2+RMW2+CMA2,factmerg)) ##等权收益回归

##

## Call:

## lm(formula = E10_1 ~ RiskPremiu + SMB2 + HML2 + RMW2 + CMA2,

## data = factmerg)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.026316 -0.009942 0.000277 0.008405 0.055846

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.0004343 0.0019095 0.227 0.820842

## RiskPremiu 0.0008215 0.0481379 0.017 0.986439

## SMB2 1.3005844 0.0776957 16.739 < 2e-16 ***

## HML2 0.4035263 0.1115964 3.616 0.000602 ***

## RMW2 -0.3100346 0.1137660 -2.725 0.008341 **

## CMA2 -0.1796167 0.1550010 -1.159 0.250978

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.01524 on 62 degrees of freedom

## Multiple R-squared: 0.9128, Adjusted R-squared: 0.9057

## F-statistic: 129.7 on 5 and 62 DF, p-value: < 2.2e-16

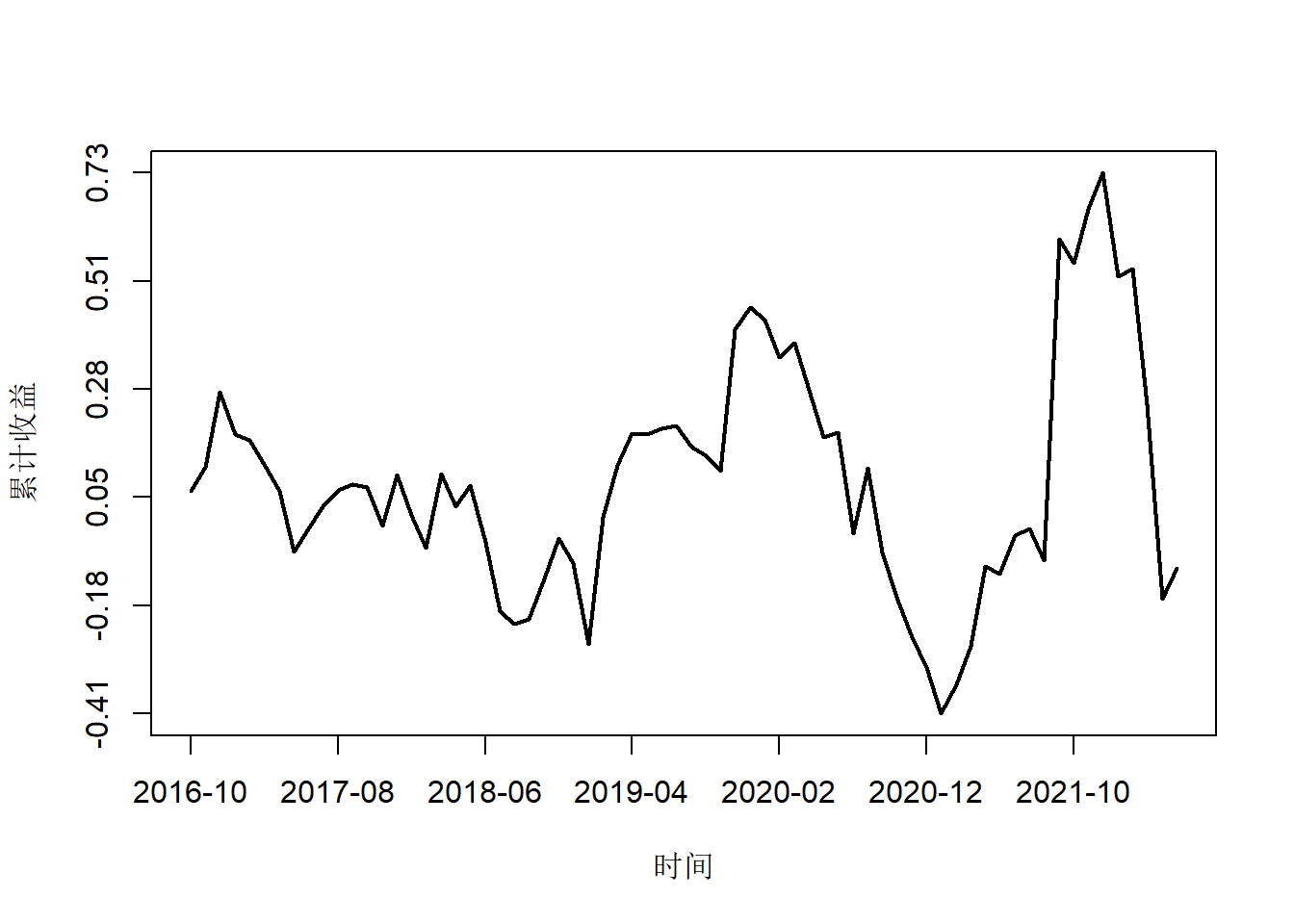

总市值分组(市值后5的股票)

pacman::p_load(data.table,stringr,dplyr,mongolite,foreign,flextable)

options(warn = F)

stockret<-read.dbf("E:/科研/五因子模型指标(月)150835535/TRD_Mnth.dbf") ##股票市值和收益数据

#

# cleandata<-stockret%>%filter(as.character(Trdmnt)>="1995-01"&!str_detect(Stkcd,"^900|^200"))%>%

# group_by(Stkcd)%>%

# mutate(LMsmvosd=lag(Msmvosd),

# LMsmvttl=lag(Msmvttl))%>%ungroup()%>%filter(!is.na(LMsmvosd)&!is.na(LMsmvttl))%>%

# group_by(Trdmnt)%>%

# filter(LMsmvttl<=quantile(LMsmvttl,0.3,na.rm=T))%>%

# mutate(Groupsd=cut(LMsmvosd,c(min(LMsmvosd)-100,quantile(LMsmvosd,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvosd)+100),labels=1:10),

# Groupmvt=cut(LMsmvttl,c(min(LMsmvttl)-100,quantile(LMsmvttl,seq(0.1,0.9,0.1),na.rm=T),max(LMsmvttl)+100),labels=1:10))%>%

# select(Stkcd,Trdmnt,Groupsd,Groupmvt,Msmvttl,LMsmvttl,Mretnd)%>%

# ungroup()%>%

# na.omit()

#

#

# Mvtotal<-cleandata%>%filter(Groupmvt%in%c(1))%>%

# arrange(Trdmnt,LMsmvttl,Groupmvt)%>%

# group_by(Trdmnt,Groupmvt)%>%

# mutate(num=1:n())%>%filter(num<=5)%>%

# summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

# mutate(Eret=cumsum(Eqret))

# mdat<-mongo(collection = "trademonthly",db="stockdata")

# datamoth<-mdat$find(query='{}')

# tsdate<-unique(datamoth$trade_date)

# tdate<-paste0("[\"",paste0(tsdate,collapse = "\",\""),"\"]")

# dailydat<-mongo(collection = "dailybasic",db="stockdata")

# mdatas<-dailydat$find(query=paste0("{\"trade_date\":{\"$in\":",tdate,"}}"),

# fields = '{"_id":0,"ts_code":1,"trade_date":1,"total_mv":1,"circ_mv":1}')%>%

# mutate(across(.cols =total_mv:circ_mv,as.numeric ))

# cleandata<-merge(mdatas,datamoth,by=c("ts_code","trade_date"),all.y = T)%>%

# mutate(Trdmnt=gsub("(\\d{4})(\\d{2})(\\d{2})","\\1-\\2",trade_date),

# Mretnd=change/pre_close)%>%

# filter(Trdmnt>="1995-01")%>%

# group_by(ts_code)%>%

# mutate(LMsmvosd=lag(circ_mv),

# LMsmvttl=lag(total_mv))%>%ungroup()%>%filter(!is.na(LMsmvttl))%>%

# ungroup()%>%

# group_by(Trdmnt)%>%arrange(LMsmvttl)%>%summarise_all(head,5)%>%

# select(ts_code,Trdmnt,LMsmvttl,Mretnd)%>%

# ungroup()%>%

# na.omit()

#

# Mvtota<-cleandata%>%

# group_by(Trdmnt)%>%

# summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

# mutate(Eret=cumsum(Eqret))

mdat<-mongo(collection = "stockbase",db="stockdata")

stocbas<-mdat$find(query='{}')%>%

mutate(Stkcd=symbol)%>%select(Stkcd,list_date)

cleandata<-stockret%>%filter(as.character(Trdmnt)>="1995-01"&!str_detect(Stkcd,"^900|^200")&Mretnd<1.5)%>%

merge(stocbas,by="Stkcd",all.x = T)%>%

mutate(tradedate=paste0(paste0(Trdmnt,"-",Clsdt)))%>%

group_by(Stkcd)%>%arrange(Stkcd,Trdmnt)%>%

mutate(Ldate=lag(tradedate),

LMsmvosd=lag(Msmvosd),

LMsmvttl=lag(Msmvttl))%>%

mutate(datelist=as.numeric(as.Date(paste0(Trdmnt,"-",Clsdt))-as.Date(list_date,"%Y%m%d")),

datedr=as.numeric(as.Date(tradedate)-as.Date(Ldate)))%>%

filter(datelist>120&datedr<42)%>%ungroup()%>%filter(!is.na(LMsmvttl))%>%

group_by(Trdmnt)%>%arrange(LMsmvttl)%>%summarise_all(head,5)%>%

select(Stkcd,Trdmnt,Msmvttl,LMsmvttl,Mretnd)%>%

ungroup()%>%

na.omit()

Mvtotal<-cleandata%>%

group_by(Trdmnt)%>%

summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

mutate(Eret=cumsum(Eqret))

plot(Mvtotal$Eret,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2)

axis(side =1,at=seq(1,length(Mvtotal$Trdmnt),10),

as.character(Mvtotal$Trdmnt[seq(1,length(Mvtotal$Trdmnt),10)]))

axis(side =2,at=seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),round(seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),2))

box(lty = "solid")

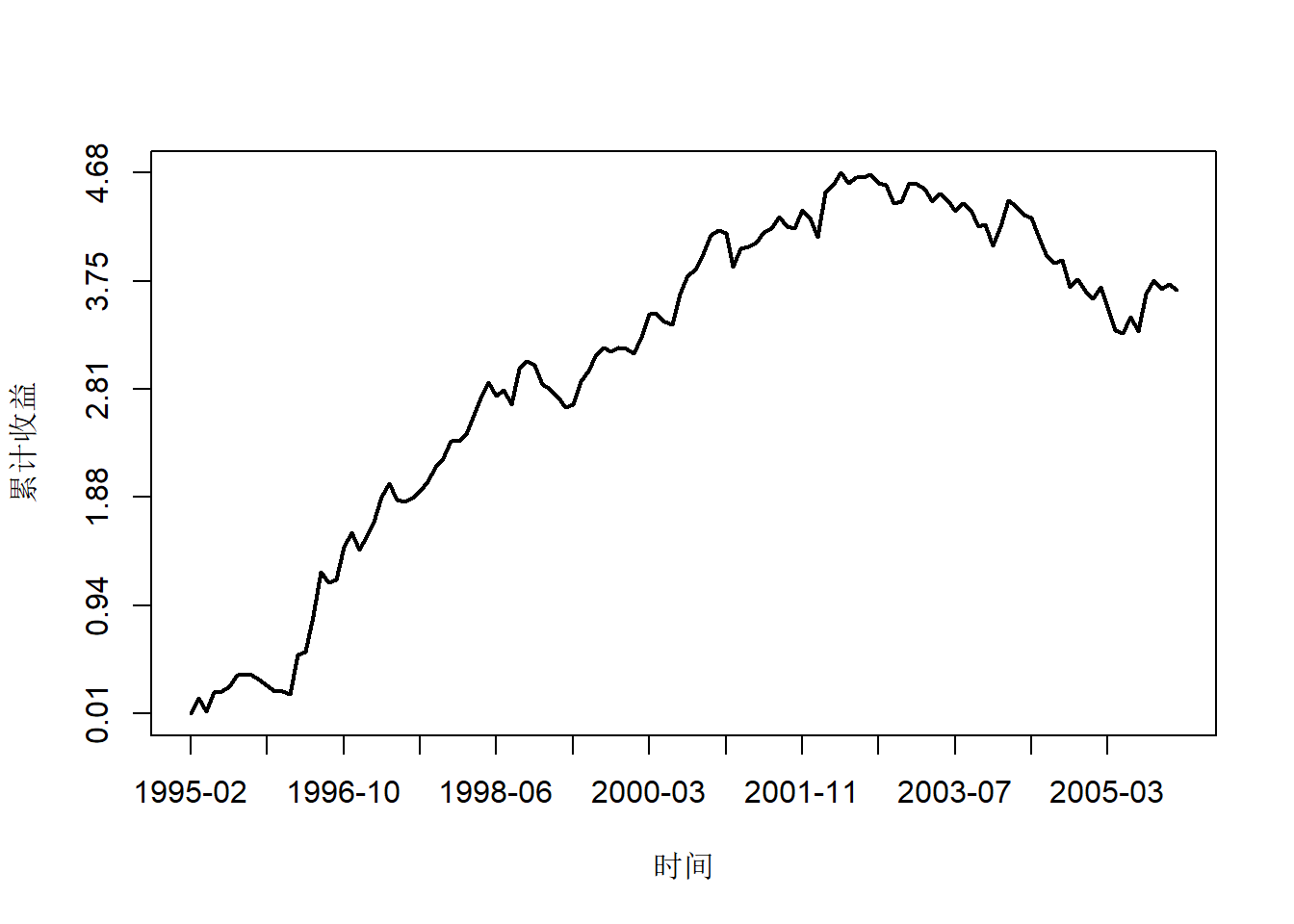

1995年1月至2005年12月(市值后5只股票)

Mvtotal<-cleandata%>%filter(as.character(Trdmnt)<="2005-12")%>%

group_by(Trdmnt)%>%

summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

mutate(Eret=cumsum(Eqret))

# Mvtotal<-cleandata%>%filter(Groupmvt%in%c(1))%>%filter(as.character(Trdmnt)<="2005-12")%>%

# arrange(Trdmnt,LMsmvttl,Groupmvt)%>%

# group_by(Trdmnt,Groupmvt)%>%

# mutate(num=1:n())%>%filter(num<=5)%>%

# summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

# mutate(Eret=cumsum(Eqret))

plot(Mvtotal$Eret,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2)

axis(side =1,at=seq(1,length(Mvtotal$Trdmnt),10),

as.character(Mvtotal$Trdmnt[seq(1,length(Mvtotal$Trdmnt),10)]))

axis(side =2,at=seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),round(seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),2))

box(lty = "solid")

2006年1月至2015年12月(市值后5只股票)

Mvtotal<-cleandata%>%

filter(as.character(Trdmnt)>="2006-1"&as.character(Trdmnt)<="2015-12")%>%

group_by(Trdmnt)%>%

summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

mutate(Eret=cumsum(Eqret))

# Mvtotal<-cleandata%>%filter(Groupmvt%in%c(1))%>%

# filter(as.character(Trdmnt)>="2006-1"&as.character(Trdmnt)<="2015-12")%>%

# arrange(Trdmnt,LMsmvttl,Groupmvt)%>%

# group_by(Trdmnt,Groupmvt)%>%

# mutate(num=1:n())%>%filter(num<=5)%>%

# summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

# mutate(Eret=cumsum(Eqret))

plot(Mvtotal$Eret,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2)

axis(side =1,at=seq(1,length(Mvtotal$Trdmnt),10),

as.character(Mvtotal$Trdmnt[seq(1,length(Mvtotal$Trdmnt),10)]))

axis(side =2,at=seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),round(seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),2))

box(lty = "solid")

2016年1月至2022年5月(市值后5只股票)

Mvtotal<-cleandata%>%

filter(as.character(Trdmnt)>="2016-1")%>%

group_by(Trdmnt)%>%

summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

mutate(Eret=cumsum(Eqret))

# Mvtotal<-cleandata%>%filter(Groupmvt%in%c(1))%>%

# filter(as.character(Trdmnt)>="2016-1")%>%

# arrange(Trdmnt,LMsmvttl,Groupmvt)%>%

# group_by(Trdmnt,Groupmvt)%>%

# mutate(num=1:n())%>%filter(num<=5)%>%

# summarise(Eqret=mean(Mretnd))%>%ungroup()%>%

# mutate(Eret=cumsum(Eqret))

plot(Mvtotal$Eret,type="l",axes = F,ylab="累计收益",xlab="时间",lwd=2)

axis(side =1,at=seq(1,length(Mvtotal$Trdmnt),10),

as.character(Mvtotal$Trdmnt[seq(1,length(Mvtotal$Trdmnt),10)]))

axis(side =2,at=seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),round(seq(min(Mvtotal$Eret),max(Mvtotal$Eret),(max(Mvtotal$Eret)-min(Mvtotal$Eret))/5),2))

box(lty = "solid")