中国A股市场的反转效应

薛英杰 / 2023-03-18

马克思的价值规律告诉我们:“商品价格围绕价值波动”。股票市场也不例外,股票价格也会围绕其内在价值波动,当价格偏离内在价值时,价格会向内在价值回归。也就是说,股票价格会发生反转。那么,中国A股的价格反转是否有周期性?如果有,平均周期是多久?投资者是否可以利用股价反转获得超额收益?

为了检验这个问题,我们按照股票历史收益对其分组,讨论不同周期组合的股票反转效应强弱。

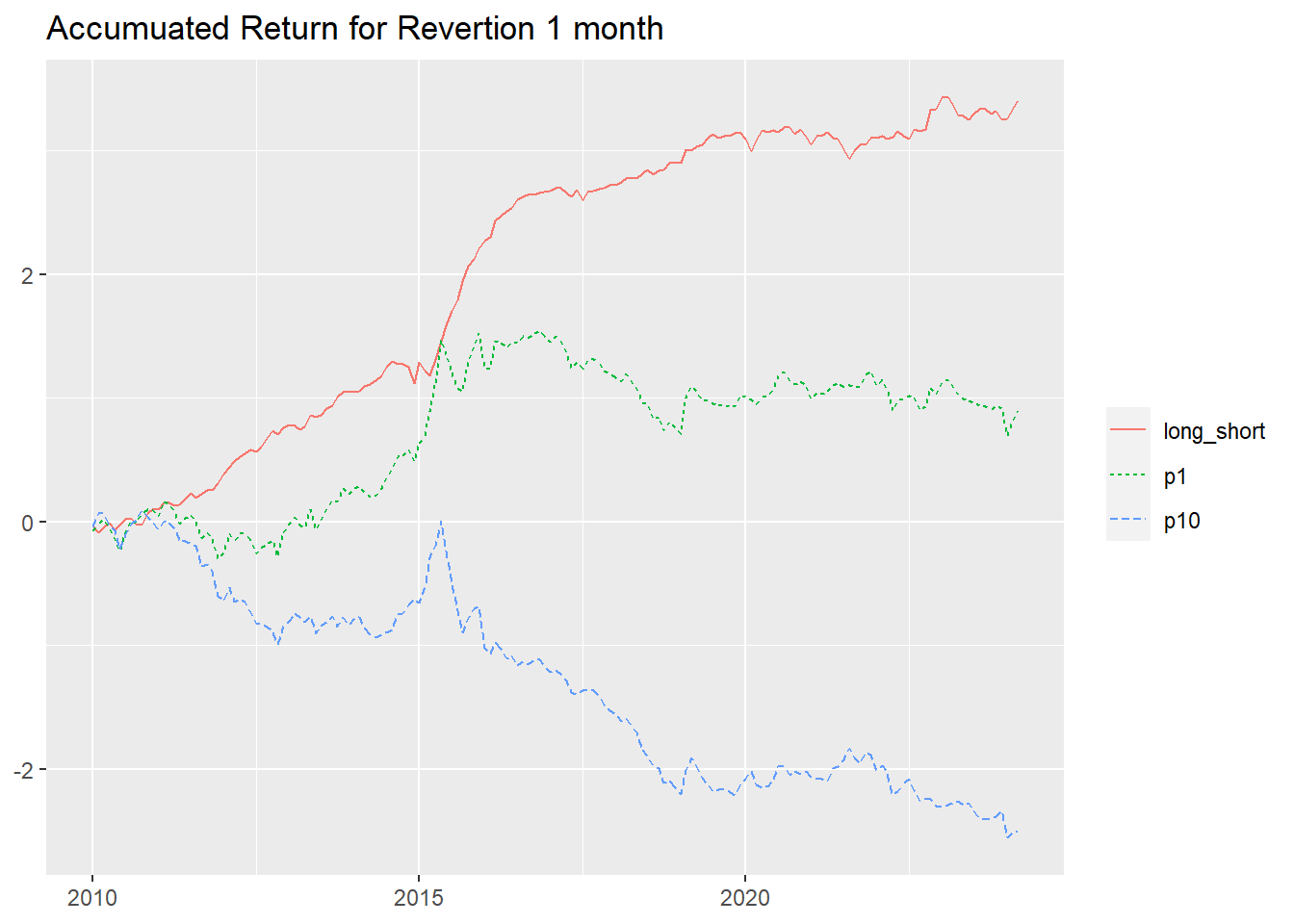

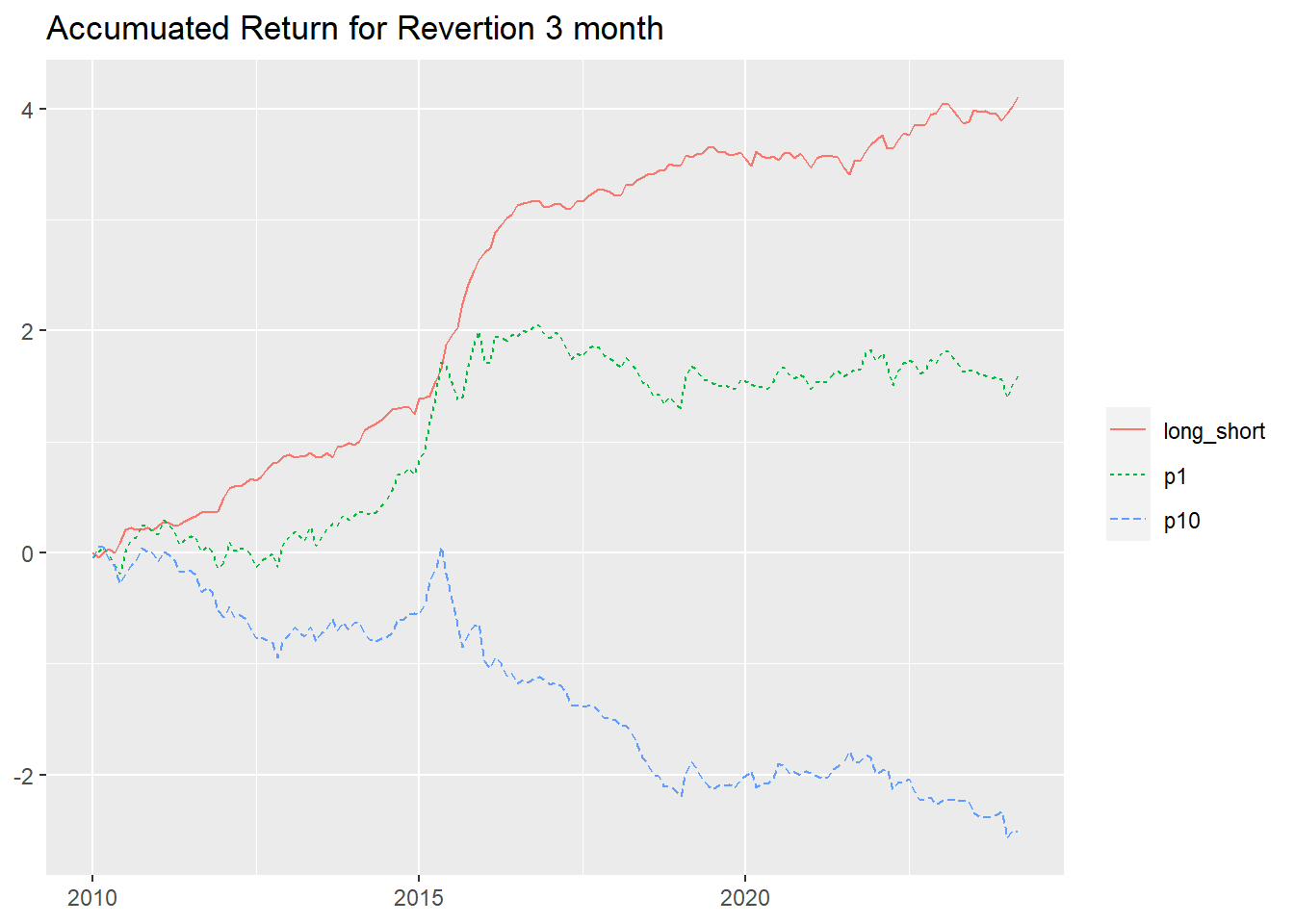

[1] 2

从多空组合收益来看,以3个月为周期的反转效应最强,但是,反转效应在多头(p1)上效果并不明显,其超额收益主要来自空头。这是由于卖空限制有关,中国市场卖空限制严重,投资者无法获取空头收益。

组合收益检验

| Dependent variable: | |||||||||||

| ret | |||||||||||

| L | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | H | L-H | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

| Constant | 0.005 | 0.006 | 0.006 | 0.005 | 0.004 | 0.005 | 0.002 | -0.001 | -0.005 | -0.015** | 0.020*** |

| (0.763) | (0.932) | (1.004) | (0.810) | (0.714) | (0.841) | (0.376) | (-0.103) | (-0.826) | (-2.300) | (5.096) | |

| Observations | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 |

| Adjusted R2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Note: | p<0.1; p<0.05; p<0.01 | ||||||||||

| Dependent variable: | |||||||||||

| ret | |||||||||||

| L | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | H | L-H | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

| Constant | 0.009 | 0.007 | 0.005 | 0.005 | 0.004 | 0.004 | 0.001 | -0.001 | -0.006 | -0.015** | 0.024*** |

| (1.322) | (1.104) | (0.836) | (0.887) | (0.692) | (0.588) | (0.185) | (-0.246) | (-0.955) | (-2.270) | (5.803) | |

| Observations | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 |

| Adjusted R2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Note: | p<0.1; p<0.05; p<0.01 | ||||||||||

| Dependent variable: | |||||||||||

| ret | |||||||||||

| L | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | H | L-H | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

| Constant | 0.008 | 0.004 | 0.005 | 0.004 | 0.004 | 0.003 | 0.001 | -0.0002 | -0.004 | -0.011 | 0.019*** |

| (1.105) | (0.712) | (0.805) | (0.630) | (0.637) | (0.516) | (0.233) | (-0.027) | (-0.688) | (-1.625) | (4.502) | |

| Observations | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 |

| Adjusted R2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Note: | p<0.1; p<0.05; p<0.01 | ||||||||||

| Dependent variable: | |||||||||||

| ret | |||||||||||

| L | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | H | L-H | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

| Constant | 0.003 | 0.005 | 0.005 | 0.005 | 0.005 | 0.004 | 0.001 | -0.0004 | -0.002 | -0.011 | 0.013*** |

| (0.411) | (0.772) | (0.753) | (0.888) | (0.765) | (0.606) | (0.242) | (-0.062) | (-0.361) | (-1.565) | (3.314) | |

| Observations | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 | 171 |

| Adjusted R2 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Note: | p<0.1; p<0.05; p<0.01 | ||||||||||

从投资组合结果来看,与累计收益的结果类似,以三个月为周期的反转收益更高,而且空头可以显著地获得超额收益。